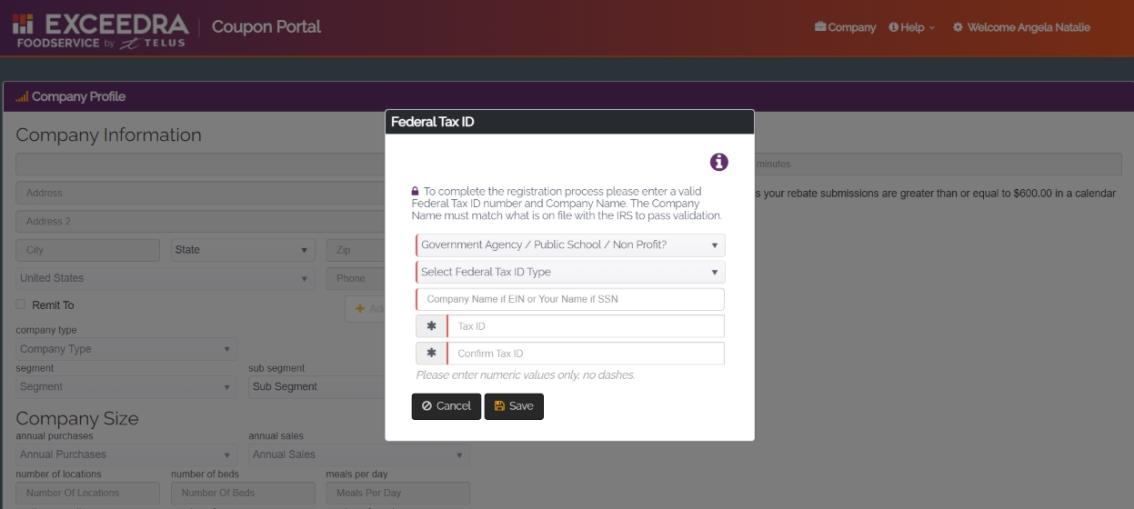

Federal Tax ID

Once the registration process is complete, when logging in you are required to set up your Company Information. The application will automatically open to the Company Profile page with the Federal Tax ID modal open. Complete the following fields:

- Government Agency/School - Yes or No

- Federal Tax ID Type - EIN, SSN or Other

- Company Name - Enter in the company name that is associated with the Federal Tax ID. (Enter in your name if you selected SSN.) The Company Name must match what is on file with the IRS to pass validation.

- Tax ID - A Taxpayer Identification Number (TIN) is an identification number used by the Internal Revenue Service (IRS). It is either issued by the IRS or by the Social Security Administration. Please enter numeric values only, no dashes.

The Federal Tax ID is a 9-digit number formatted like the following:- EIN - XX-XXXXXXX

- SSN - XXX-XX-XXXX

- Other (ITIN) NNN-NN-NNNN

- Confirm Tax ID - Reenter Tax ID.

Upon clicking Save, your information gets sent to the IRS for verification. You will see a "Pending Verification" message it may take up to 15 minutes to get accepted by the IRS.

If you are not a Government Agency and the Federal Tax ID and Company Name do not pass validation, a failure message will display and you will have to re-enter your information.